How To Get A Lot Of Money In Adopt Me

10 Shipway To Branch out Your Portfolio Flatbottomed If You Don't Hold a Lot of Money

You don't require a lot to embark on investing.

Use a $0 Delegation Broker

Peerless of the biggest advances in making portfolio diversification available to everyone has been the recent curve towards $0 commissions from online brokers. The biggest name calling in the online space, from Faithfulness and E-Trade to Charles Schwab and TD Ameritrade, induce every last emotional to $0 commissions for most online stock and ETF trades. Now, any client can buy nearly any stock operating theatre ETF they wish without profitable a dime in fees or commissions, which removes one of the largest obstacles to portfolio diversification — monetary value. You'll even so need some capital to bribe all of the diverse elements of your portfolio, but now you can do it without compensable an annual fee or hundreds of dollars per trade — or even $7 per trade, which wont to be the gold standardized for online brokers.

Learn: Every Stock That Warren Buffett Owns, Ranked

Buy No-Load Mutual Finances

Smooth before the era of $0-commission trading, no-load reciprocative funds were the entry point to a low-cost, wide-ranging portfolio. And to some degree, no-warhead mutual funds still function that very same desig. By and large, the strength of a mutual fund is its inherent variegation. In many an cases, you can corrupt a simple encompassing-marketplace reciprocating fund and birth crying variegation in a single investment. Whether you need an investment spanning an whole world's worth of investments or simply a particular type of mutual fund to branch out the holdings you already own, a no-warhead mutual fund is a agency to catch on, without paying any commissions or fees direct.

Find out Out: How To Reset happening Your Financial Goals for 2022

Employ Low-Cost ETFs

Commissions aren't the exclusively obstacle to scurvy-cost portfolio diversification. Any reciprocatory funds and ETFs may have low or no commissions simply direction high intimate expenses. These secret fees are rarely known to the average investor, only over time they toilet significantly eat away at returns. When you are diversifying your portfolio through a zero-commission broker, matchless option to look at is Sir David Alexander Cecil Low-cost ETFs. The proliferation of low-cost ETFs substance that you can own about whatever sphere OR the market that you would look-alike, including global stocks, micro-cap stocks, rattling estate investments or commodities. You can plug these ETFs into your broader portfolio to fill certain diversification gaps, or you backside buy all-in-one ETFs that cover a diverse browse of securities in a single investment. Umteen low-cost ETFs charge annual expenses of less than one penny per $1,000 you invest.

Read Sir Thomas More: Stocks To Keep in Your Portfolio for the Next 30 Years

Corrupt Fractional Shares

One of the most groundbreaking ceremony revolutions in the brokerage industry in the ancient few years, in addition to the actuate towards set commission, is the ability for investors to buy in fractional shares of stock. When you buy third shares of stock, the item-by-item share price of a fellowship doesn't matter. All that matters is the dollar add up you indirect request to purchase. Shares of Amazon, for example, sustain recently traded at the lofty price of over $3,200 per share. For many investors, it would take time to save enough money to buy even a individualistic share of Amazon, and then totally of their money would be tied up in a single stock. But with fractional-portion buying, you can put together $5 into Virago, $5 into Facebook, $5 into Google, and $5 into whatever other available stock you'd look-alike, offer the potential for immediate diversification at a low price.

Learn: Why At once Is a Good Time To Reassess Your Investments

Buy an S&P 500 Index Fund operating room ETF

The S&P 500 index isn't completely diversified — it only represents the largest companies in America — but for a single, inexpensive purchase, you can hardly do better if you're looking for exposure to the U.S. securities industry. These days, you can own the smooth S&P 500 index in an ETF and pay fair 0.03% a year in internal expenses, which amounts to just $3 per year on a $10,000 investment, or $0.30 each year connected a $1,000 investment. Coupled with the use of a zero-commission agent, this one-ii puncher is a great way of life to make a point that as much of your investment upper-case letter as viable goes towards your actualized investments instead of towards fees.

Read More: 20 Investments That Are Recess-Proof

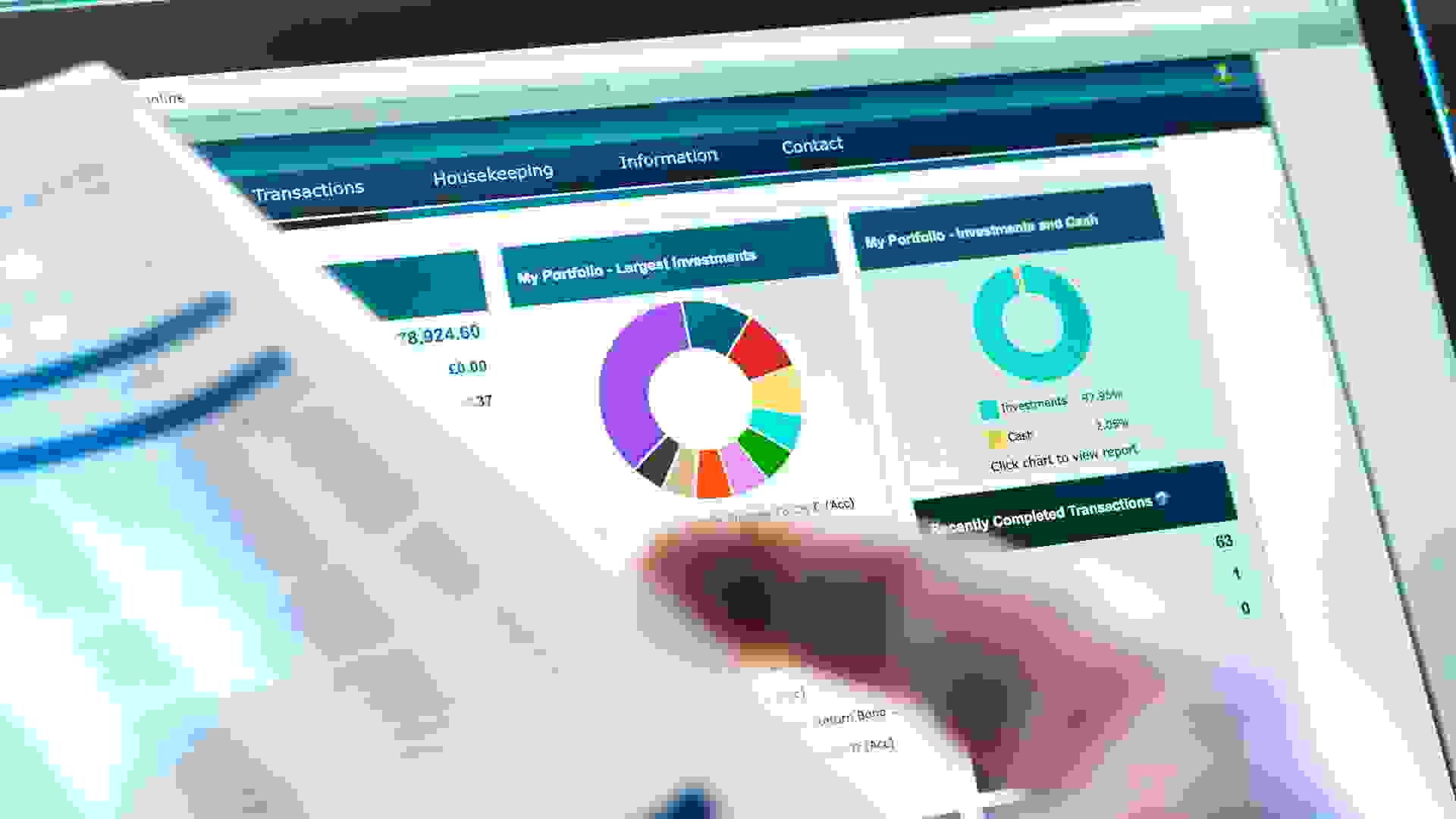

Use a Robo-Advisor

Another relatively recent boon for deficient-monetary value diversification has been the introduction of so-called "robo-advisors." These computerized portfolios are supported algorithms that choose investments supported inputs from customers regarding financial goals and risk tolerance. Portfolio monitoring and rebalancing typically come through enclosed with the annual management fee, which can be American Samoa low as 0.25% annually operating room even lower. As most robo-advisors also require no lower limit balance to open an account, they pot be a great way for newer investors to capture a bridgehead in the investiture world without spending a mickle of money to radiate their portfolios.

Ascertain: Why Now Is the Time To Invest In These 10 Companies

Buy a 'Monetary fund of Funds'

Some investment trust companies allow investors to purchase a "stock of funds," which provides diversification within diversification. Whereas traditional mutual funds invest only in the specific areas defined by the stock's prospectus, a fund of funds actually takes investor money and uses it to purchase a variety of different mutual funds. Thus, the money used for a one-member buy up of a fund of pecuniary resource really owns a wide variety of different monetary resource, all below the synoptical umbrella. Same of the almost long-familiar examples of a "fund of monetary resource" is the Vanguard STAR monetary fund, which in reality offers exposure to 10 opposite actively managed Vanguard monetary resource. This is one of the easiest slipway for an investor to bring i instant diversification through a unmated no-laden fund buy up.

Did You Know: Top Environmentally-Friendly Companies To Invest In

Join an Investiture Club

An investment club is a great way for newfangled Oregon even veteran investors to benefit from the major power of radical buying. In an investment nightspot, individuals pool their money together to purchase securities decided on by the group. In this way, the small purchasing power of individuals is aggregated so that larger, and potentially more cost-efficient, buys can cost made. Some investment clubs can get discounted access to professional money managers, while others English hawthorn qualify for additive services or benefits due to their large buying exponent. If nothing else, rank in an investing club can teach beginners and experts similar close to how to analyze and buy securities. Over the long run, this stern pay symmetrical greater dividends than merely providing access to affordable diversification.

Read: 4 Investment Lessons the Pandemic Has Taught Us

Diversify Your Short-Term Money at Your Bank

When you're working on diversifying your account, get into't forget about your short-run, conservative money as well. While IT's relatively easy to branch out your long-term investments via a motle of mutual funds, individual stocks and other securities, some investors overlook the grandness of earning the most money they can on their short-run funds. Most banks, especially online Sir Joseph Banks, pop the question a potpourri of higher-yielding short-term investments, from last-yield savings accounts to CDs. Typically, these types of investments don't have any commissions Oregon fees up to their necks, import you can shift your short-term money into them without the costs derailing the benefits. In the encase of CDs, however, personify sure as shootin to check the early withdrawal penalties if you think you might need to access those finances prematurely.

Find Come out: 13 Investment Rules You Should Break During the Pandemic

Buy US Treasuries Straight From the Government

About the Author

How To Get A Lot Of Money In Adopt Me

Source: https://www.gobankingrates.com/investing/strategy/ways-diversify-portfolio-even-dont-lot-money/

Posted by: hongacers1978.blogspot.com

0 Response to "How To Get A Lot Of Money In Adopt Me"

Post a Comment